Hi, I'm Peter Rose, Founder of Longwood Currency Trading, and welcome to LCT Blog Post 12/09/21 — How To Correctly Time A FOREX Trade Entry.

Hi, I'm Peter Rose, Founder of Longwood Currency Trading, and welcome to LCT Blog Post 12/09/21 — How To Correctly Time A FOREX Trade Entry.

An integral part of entry analysis is determining the viability of the trade beyond just that the conditions are good.

If you get the timing wrong, there is a strong probability that price will retrace against you almost immediately, and you’ll get stopped out.

The solution to this issue is to recognize that the greater the distance between when you do your entry analysis and the actual point of entry, the higher the probability will be that those entry conditions could very well have changed.

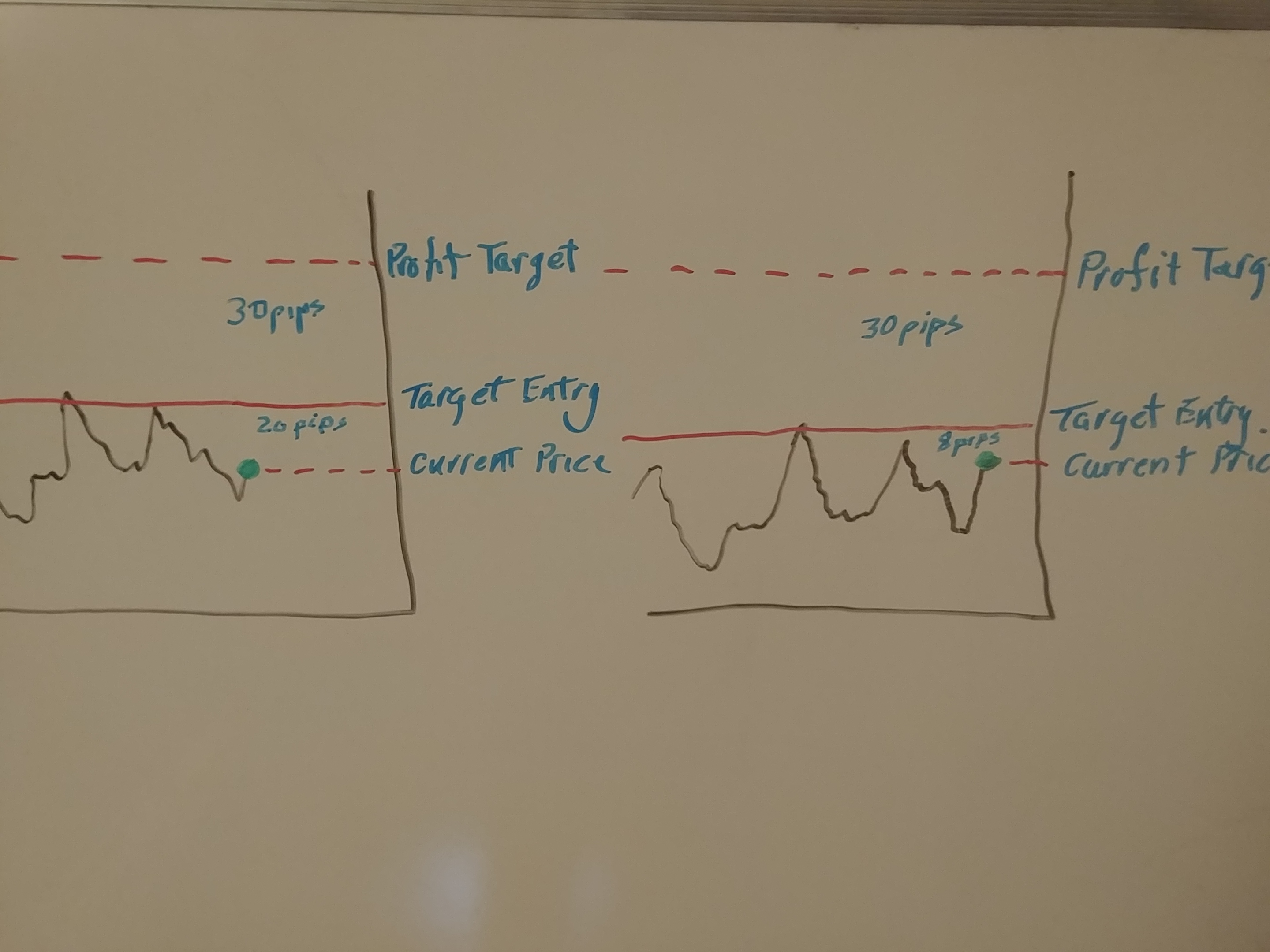

The following rough diagram, 'Trade Entry Distance Analysis' shows this:

Trade Entry Distance Analysis

The green circle on both graphs shows the current price position. Both graphs indicate a potential 30 pip profit target, thus giving enough potential gain to warrant taking the trade — just as a basic, very simple example.

However, the graph on the left shows that price must move 20 pips before a good entry point is found, whereas the graph on the right shows only 8 pips are required.

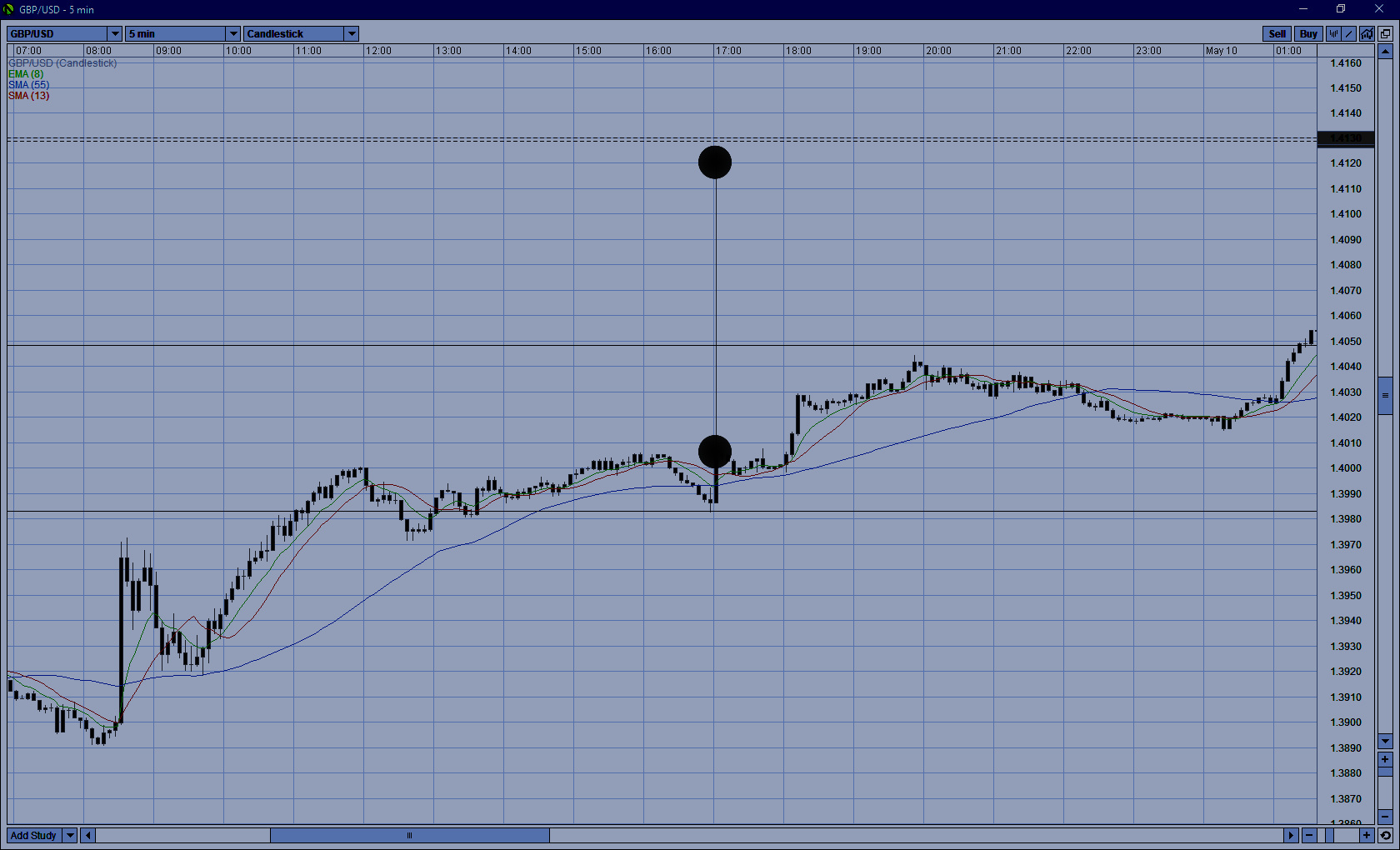

Though 20 pips may not seem to be a long time to wait to trigger a buy limit order, it very well could be. As I mention in the 'Pin Bar Reveals FOREX Lies' blog post as well as in a video, I show where price went through a 137 pip pin bar in 1 minute.

05/09/21 1700 US ET GBP/USD 1 min 137 Pip Pin Bar - with markers

Waiting 20 pips to your take point is a life-time in comparison. And thus, the advice would be that though you can map such an entry strategy out at where current price is, you should do another full trade entry analysis as price actually gets close to that take point.

In the case of the graph on the right, the 8 pip distance to the take point is far more reasonable to rely upon that initial trade entry analysis. However, out of an abundance of caution do exactly what you do when pulling across 2 lanes to turn onto the far lane: look both ways several times before actually pulling out.

So too in your trade entry process: regardless of proximity to take point, when price gets ready to hit that limit order, do a quick re-evaluation of price action to make sure nothing has changed.

You'll be surprised at how often you cancel that limit take order....

Companion VideoHere's that companion video of the same title: How To Correctly Time A FOREX Trade Entry I mentioned at the start of this post that puts all of this together from a different view point.

Thanks for taking your time to read this post,

Peter

p.s. For more of my thoughts on trading in the FOREX foreign currency market, check out my YouTube channel for Longwood Currency Trading