Hi, I'm Peter Rose, Founder of Longwood Currency Trading, and welcome to LCT Blog Post 03/31/22 — Critical FOREX Trade Entry Setup Guidelines.

Hi, I'm Peter Rose, Founder of Longwood Currency Trading, and welcome to LCT Blog Post 03/31/22 — Critical FOREX Trade Entry Setup Guidelines.

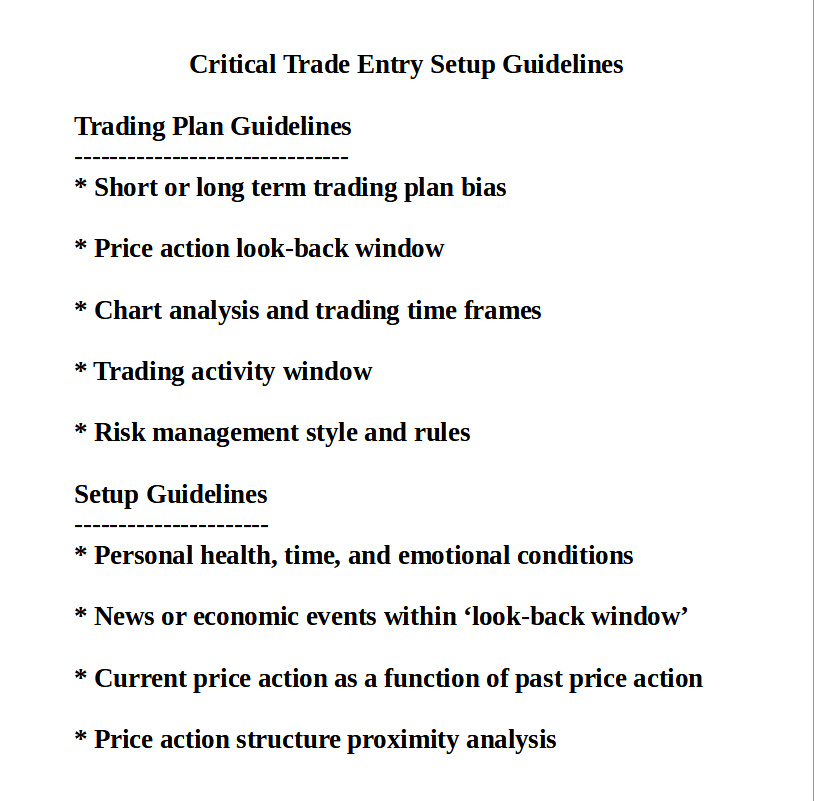

In considering trade entry guidelines, I think it's important to distinguish between those guidelines that form the base of strategic issues for trade entry from those more tactical implementation issues during real time setup analysis.

- Trading Plan Guidelines

- Setup Guidelines

If you don't establish a good base for this analysis in the trading plan, they you'll be faced with too many decisions in real time. You avoid this by laying out some specific strategic considerations for the trade entry phase or your positions ahead of time.

Because looking at real time price action is quite different than kitchen table analysis, you'll need more tactical oriented guidelines at that point. And that's the reason for the separation of this discussion into those 2 major topics

What I've done for you is then take each major topic and identify just a few critical things that I think would be most helpful for you to consider. Though there are other considerations, I think these should give you a great base to develop your own implementation plan.

Here's an outline of the topics I'll cover in this post, and which I spoke about in the video:

Critical FOREX Trade Entry Setup Guidelines

Trading Plan Guidelines

Short or long term trading plan bias

To be successful at not just your trade entry, but for all of your trading activity, I believe it's critical that you establish right up front exactly what your trading time frame bias will be.

I believe (as in I believe...) that you should either be a short term trader (scalper or day trader), or a long term trader (swing or position trader). I don't think it's wise to one day do day trading, and then decide that on Wednesday you'll swing....

Price action look-back windowBased on establishing your trading time frame bias, you then need to determine what your price action look-back window should be.

Your price action look-back window is how far back on that time frame chart you will be incorporating into your current price action analysis. If you're trading on a 5 minute chart, then what value to you is there in looking back to what was going on a month ago?

This is different than using multiple time frame analysis. This is looking at the institutional trading activity as a function of macro economics of the market. If you don't get this: you should not be trading large lot size in this market.

Chart analysis and trading time framesConsistent with establishing your trading time frame and look-back window is that of matching those with the correct analysis and trading time frames.

This is the basis of multiple time frame analysis, but it is not multiple time frame analysis. It's rather establishing the time frames that you will use to do multiple time frame analysis.

Hopefully you understand the difference, because if you don't you'll end up solving the wrong problem in real time.

Trading activity windowYour trading activity window is simply the segment of time on a daily basis that you have designated for your analysis and trading.

If you need to be out the door at 7:00 am to get to work, not returning until 7:00 pm, and you can't check prices between those hours, then your trading activity window (or windows) must be defined outside of those working times.

Seems pretty obvious, but the ramifications of not setting up a structured framework for the times where you will trade can be catastrophic. This trading plan guideline directly impacts real time trade entry setup analysis.

Risk management style and rulesThis is a very, very complex topic at the tactical level, but inordinately simple at the strategic level, because: If you get it right here, the implementation tactics become fairly straight forward.

However, if you don't get this stuff established up front, then — in my opinion — you will find it very difficult to establish consistency in your trading.

Setup Guidelines

Personal health, time, and emotional conditions

If you're not feeling well — either physically or mentally — then you're just going to create more discomfort for yourself trying to trade.

And when positions fall apart on you, believe me when I caution you that you'll be compelled to do either or both: anticipatory trading (of which I've done numerous videos and other blog posts on), and/or revenge trading.

News or economic events within 'look-back window'All of speculative trading is based on determining if what happened in the past will or will not continue into the future, and if it has the possibility of continuing, then how far will it continue. News or economic events within that 'look-back window' directly, and potentially negatively, impact your ability to determine any of that 'predictability'.

Current price action as a function of past price action

Current price action as a function of past price action is the use of that past price action to specifically determine if what happened in the past will or will not continue into the future, and if it has the possibility of continuing, then how far will it continue.

Price action structure proximity analysis

Proximity analysis is one of the final checks you do in your trade entry analysis. It has to do with evaluating the pip distance to the closest support or resistance zone.

Close proximity is a function of entry point to profit target distance: if too close, then you have to pass on the trade.

Companion VideoHere's that companion video of the same title: Critical FOREX Trade Entry Setup Guidelines I mentioned at the start of this post that puts all of this together from a different view point.

Thanks for taking your time to read this post,

Peter

p.s. For more of my thoughts on trading in the FOREX foreign currency market, check out my YouTube channel for Longwood Currency Trading